30 IRS Red Flags that Might Trigger a Tax Audit

Who gets audited — Are there IRS Red Flags that taxpayers should Avoid?

Do you ever wonder why some people’s tax returns are targeted by the IRS for audit while the majority are accepted on face value?

Do you ever wonder why some people’s tax returns are targeted by the IRS for audit while the majority are accepted on face value?

Generally speaking, the IRS audits slightly more than 1% of all individual tax returns each year. The IRS simply does not have the personnel necessary to examine too many more than they currently do, so they purpose to audit specifically-selected returns by finding and identifying the tax returns that will most likely result in uncovering unreported income, overstated deductions, false claims, or tax payers that haven’t filed tax returns in a while. So while the odds are in your favor that you will fall into the 99% of non-audited tax returns, there are some IRS Red Flags that, IF YOU CAN AVOID, will help keep you from the audit pool group.

Your chances for being contacted or audited by the IRS are dependent upon many factors, including your annual income, if you omit income yet the IRS has filings and notifications to the contrary, the types, sizes and ratios of deductions or losses you claim, whether you work for a company and in what field you work, if you own a business and the type of business you own, and if you own foreign assets or bank “offshore.” Sloppiness in tax return preparation, errors in math, discrepancies between state and federal tax returns, or wide fluctuations in reported earnings from one year to the next year may also trigger an IRS inquiry, but may not expand into a broad audit. Although there is no guaranteed way to avoid an IRS audit, you should be aware of common IRS red flags that will certainly increase your chances of drawing unwanted attention or an audit from the IRS.

Here are 30 Common IRS Red Flags that could trigger a Tax Audit:

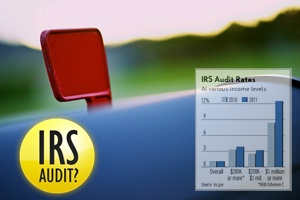

- You make too much money – There’s not much you can do about this KEY RED FLAG, but the cruel reality is that government tax agencies are tasks with collecting as much money as they can, so they naturally go “where the money is!” Although the overall individual audit rate is about 1.11%, the odds increase dramatically for high-income filers. IRS statistics prove that in 2011 taxpayers with incomes of $200,000 or more had an audit rate of 3.93%. A 400% greater likelihood! That $200,000+ group is subject to audit —1 of 25 returns in that group. Taxpayers who reported $1 million or more suffered a 1 in 8 chances for being audited. The audit rate drops dramatically for taxpayers reporting less than $200,000 where only 1.02% of tax returns were audited during 2011.

- You make too little money — Your income is suspiciously low for your job description or profession and the computer tables will point you out as making much less than others in the same profession.

- Significant changes in income — Unexplained fluctuations in income can indicate that something may have been under reported in one of the low income reporting years. Most taxpayers do not have income that swings dramatically up-and-down, and the IRS will want to know what’s going on.

- Failing to report all taxable income – Remember, the IRS gets copies of all 1098’s, 1099’s, and W-2’s. If you miss some and your income reporting does not match the records the IRS has, you are more likely subject to audit.

- You own a business – Business owners are simply “low hanging fruit” for revenue agents who know that they can almost always find overlooked or underpaid tax liabilities. You are a targeted group.

- You own a business and do so as a sole proprietor – You are even more of a target than incorporated business owners —as are all Schedule C filers. You might want to consider incorporating where a Schedule C is not used.

- You own a mostly-cash business or work in a “cash business” – If it can get worse than a sole proprietor this is it! You have a billboard-sized target painted on your back if you operate a business know for mostly-cash transactions. Examples: taxis, limo services, car washes, bars, restaurants, dry cleaners, laundromats, vending routes, waiters and waitresses, etc. Advice? Play by the rules. Keep good records. IRS Revenue agents know how to conduct forensic accounting which is very effective at identifying under reporting taxpayers.

- Family members on business payroll — One common method to dodge taxes is to “hire” a family member (perhaps a college-aged student) in order to take more money out of a business at a lesser-taxable rate. There is nothing illegal in hiring a family member so long as they are actually doing the work and you can prove it when asked by an IRS revenue investigator.

- Unlikely business deductions — It may be tempting when doing your taxes in April to book your 18-year old’s computer purchased on December 22nd as a business deduction. What about the iPad you purchased the day prior to your wife’s birthday? How about that ski trip to Colorado for your wedding anniversary – are you really going to expense the gas, hotel, and meals as a business trip? Auditors will have the birth dates of your family members, possibly your wedding date, and are trained to look for significant purchases and expenses in the days immediately prior to birth dates, anniversaries, Christmas, etc. to verify large-dollar purchases, travel, and that entertainment expenses are really business-related. IRS revenue officers would make great party guests —oh the stories they could tell. Be conservative and responsible in booking business expenses and deductions.

- Claiming higher-than-average deductions – If the deductions on your tax return are disproportionately large compared with your income, the IRS computers may refer your return for human review and possible a follow-up audit.

- Claiming the home office deduction – a Red Flag for decades. The IRS has been super-vigilant and skeptical of tax returns that claimed the home office deduction and the associated write-offs because the IRS had been very successful in discrediting many of the home office claims for decades. To claim this write-off, you must use the “claimed square footage” exclusively and regularly as your principal place of business. This rules out shared rooms and spaces. Revenue agents always want to conduct these audits at your home for good reason. CAVEAT: The home office red flag of the 1990’s, is no longer as large a red flag as there has been an explosive increase in freelancers, and telecommuters who work from home and legitimately choose to take this deduction. The Internet has had significant influence on this trend, coupled with the on-going recession beginning back in December 2007. Workers who were laid off, have morphed into a huge new demographic of the self-employed 1099-workers attempting to re-establish their careers from home. It remains a red flag, so if you are targeted to be audited, the IRS will likely want to check out your home office and literally measure your square footage with a personal visit to make sure you are not abusing the law.

- Deducting business meals, travel and entertainment – Schedule C is a long list of tax deductions for those who are self-employed. On the other hand it is a punch-list for IRS Revenue Agents who are looking to shoot down those same deductions for over-reach. Agents are adept at lopping off travel expenses, personal meals, and other less-than-solidly-documented claims that fail to live up to the deduction rules. To qualify for entertainment and dining deductions, you must keep explicit records that document for each expense the amount, the place, the names and business relationships of people attending, the business purpose and the nature of the discussion or meeting. Moreover, to stay clear of scrutiny and formal-contest or worse…, such deductions should not closely coincide to holidays, family members’ birthdays, wedding anniversaries etc. Agents have a list of all your family member’s birth dates and likely your wedding date. IRS investigators are rewarded for being good at uncovering “iffy” expenses and deductions and if they challenge one, often past years returns are then added to the audit examination. Better not to stretch the truth. Best to be very conservative in the business deductions you choose.

- Claiming 100% business use of a vehicle – Another red flag that triggers IRS review is use of a business vehicle. When you depreciate a car, you have to list on IRS Form 4562 of what percentage of its use during the year that you claim (testify on a Federal form by your signature) was for business. Claiming 100% business use of an automobile is a foolish blunder – even if true (for those who would rather pay a few bucks in exchange for being lower on the computer audit scoring). Because the IRS knows that it is extremely rare for an individual to actually use a vehicle 100% of the time for business, especially if no other vehicle is available for personal use. Consider being conservative here just to reduce yet another line item that brings increased scrutiny.

- Claiming job expenses – If you work for a company or business whereby you receive an annual Form W-2 listing the amount of wages you received including taxes that were withheld from your wages during the year, you are entitled to take a deduction for expenditures you made during that tax year that are directly connected with the performance of your job. But there are three conditions that must be met: (1) the total of all claimed expenses must exceed 2% of your Adjusted Gross Income, (2) the expenditures must be both “ordinary and necessary,” and (3) the expenses were not reimbursed or reimbursable by your employer. A lot of private and some public school teachers fall into this demographic.

- Wrong or indecipherable social security number – Not double-checking ones return before filing is plain old sloppiness which accounts for many needless audits.

- Discrepancies between state and Federal tax returns — This is just another example of sloppiness and how it can come back at you. Be sure that your information matches on both your state and Federal returns. Government tax agencies talk to each other and compare notes.

- You have been audited before – Once audited, you may remain on the “suspect list” for a few years. Tread carefully and file conservative returns.

- You picked a second-rate, self-serving tax preparer – Some devious tax preparers will advertise or promise that they can deliver huge tax refunds when compared to other tax preparers. The huge refund they calculated may have earned them a fee and now you will pay the bigger price of a follow-up audit. When selecting a tax preparer, find a full-time professional and insist they go conservative on any deductions or claims that might be sketchy, out of the norm, hard to document, etc. Moreover, if a particular tax preparer is “known” by the IRS as filing over-reaching or sloppy returns, you may be targeted for audit JUST BECAUSE of the tax preparer you selected. Be careful. Check references. File conservative tax returns if you want to stay anonymous as per the government tax authorities.

- Claiming large charitable deductions – if your claimed charitable deductions are disproportionately large when compared with your income, you are asking that your return be kicked out for review and possible audit. The IRS has tables and “normal ratios” of what average charitable donations are for people in your similar demographic and similar income level. If your charitable deductions are greater than 10% of your income, make certain that your records are in order and that an audit would not cause you other troubles. It is lawful, certainly, to give as much as you wish, but we are discussing the likelihood of being audited and what the norms are before “red flags” are triggered.

- Guessing when a stock or investment was purchased or sold – the IRS knows these dates, so if your dates do not line-up, suspicion goes up that you might be hiding something.

- Using Round numbers — It’s unlikely that your investment returns were exactly $1,500, or that your mortgage interest deduction was $12,000. Recording multiple round numbers on a return are a red flag of a sloppy taxpayer, or that something sketchy is going on.

- You don’t regularly file your tax returns – A Taxpayer already flagged as a “non filer” adds to the chances for an audit

- Claiming rental losses – This is a big red flag area and complex too. Taxpayers who purchase income property, must measure their primary occupation and their “real” role in the management of their property – and that will determine how much can be legally written-off in rental losses each year on an investor’s tax return. If you show income from your “primary job or other business activity, and still want to claim rental-property losses, be very wary. It is always best to get a tax professional’s input when claiming rental losses.

- Writing off a loss for a “hobby activity” – if you have some income from a hobby that is also considered “fun” such as boat, car or horse racing, and you file a Schedule C with large losses against a “hobby business” you are asking for scrutiny. Take for example a dentist who earns a sizable $550,000 in income and then chooses to deduct a long list of expenses for the operation and maintenance of his year-old yacht, claiming it is being marketed for part-time fishing trip charters. That dentist should not be surprised when an IRS agent, making a fraction of the dentist’s earnings, wants to schedule an up-close, look-see and tax-return audit.

- Large casualty losses – If your home and personal property was destroyed by fire, tornado, hurricane, flood, earthquake, theft or other trauma, you or your tax professional is encouraged to read closely the requirements of the IRS regarding casualty, disaster, and theft losses before you file. You can read all about that HERE.

- Engaging in large currency transactions – The IRS gets many reports of cash transactions in excess of $10,000 involving casino visits, banks deposits and withdrawals, and via car dealers and similar cash businesses. At our law offices we have an outside vendor who fell a month behind on their mortgage and was required to bring $6,800 to the bank that services their mortgage to prevent a late charge and a credit ding report to a credit reporting company. They went to withdraw $6,800 in cash from a close-by Bank of America where they had a savings account. The teller wouldn’t release the money without our vendor agreeing that the bank teller had to first fill out an IRS reporting form. It appears that B of A has a policy of reporting all cash deposits or withdrawals that exceed their $6,500 cash-reporting threshold. After discussing the matter with a bank VP that knew our vendor, he withdrew $5,000 that day, and came back more than 24 hours later the following day to withdraw the remaining $2,300. Many banks report large cash withdrawals but never inform their customers that they do so.

- You fall in a targeted industry – Every year the IRS selects its latest group of targeted professions (some say “victims”). One year the IRS audits car washes, the following year chiropractors, yet another year, any business deemed to be a mostly a “cash” business… It may be by chance that you fall into a focused demographic targeted for audit.

- Failing to report a foreign bank account – The IRS is rabidly-focused on any individuals who have offshore bank or securities accounts —especially those in tax haven countries. Enough said. If that is you, contact a tax attorney at once.

- Common math errors – If you mess up on your math, the IRS is going to wonder what else you were careless with. Better to double and triple-check your numbers before you mail or press the “submit” button.

- Handwriting your return – While this seems so minor a red flag as compared with, say, recording your dependent’s Social Security numbers wrong, handwritten tax reports now stand out simply because it is now so unusual. Better to fill out a PDF form online and print a hardcopy and then mail it – print out “your copy” and whenever possible, electronically file your return.

Parting Comments for Taxpayers being cautious of Triggering IRS Red Flags

If you have legitimate job expenses, currently deductible rental losses, significant charitable contributions, home office expenses, or Schedule C losses you still might want to take a step-back and rethink the “bigger picture” before piling up one or more so-called “IRS red flags” deductions, expenses, write-offs on your tax return if:

- Are there are other items on your current year’s tax return (or on your last 2 years’ tax returns) that you really wouldn’t want the IRS to closely scrutinize because of an audit that is triggered by the return you are currently preparing.

- If the monetary expense and mental stress that is a “given” for most taxpayers following legal notice of an audit resonate with you, consider then… are the various deductions, expenses, write-offs you are now “considering claiming” worth it? Or would you trade a few “red-flag” income offsets so as to remain in the 99% group who won’t have a greater chance of an IRS audit?

When in doubt, it might be a good idea to review your proposed tax return options with the help of a qualified CPA, IRS enrolled agent, or —if you value attorney-client privilege— seek the counsel of a tax lawyer.

If you do decide to take advantage of the tax savings possible by using one or more of the more-common red flag deductions, there are some things you can do to reduce the chances of “standing out” from the crowd:

- Make certain that you file your return on time;

- Use a respected CPA, IRS Enrolled agent/preparer, or tax lawyer to assist in preparing your tax return

- Have the CPA, IRS Enrolled agent/preparer, or tax lawyer sign your tax return as tax preparer; or

- If you insist on self-preparing, use a well-know software program to prepare your tax return;

- Whenever possible, file your tax return electronically – not by mail; and

- Attach explanatory forms and/or statements to your tax return where necessary.

Get some help —Make that call!

Are you facing an audit, or afraid you might becoming an audit candidate? – The Tax Resolution Lawyers at Vincent W. Davis & Associates, provide a no-obligation, confidential consultation and have appointments available for evenings and weekends. Moreover, we accept all major credit cards and can make other payment arrangements so that we can help you get your tax problems straightened out without adding additional layers of financial burden on you and your family. We have seven convenient offices throughout Southern California, including Los Angeles County, Orange County, Riverside County and San Bernardino County. To schedule a confidential consultation with one of our Tax Resolution Lawyers, call 626-446-6442.

Where We Can Meet You? - Contact An Attorney Now

Arcadia Office

150 N. Santa Anita Ave,

Suite 200

Arcadia, CA 91006

Phone: (626) 446-6442

Fax: (626)-446-6454

Beverly Hills Office

9465 Wilshire Blvd.

Suite 300

Beverly Hills, CA 90212

Phone: (310)-880-5733

La Mirada Office

Cerritos Towne Center

17777 Center Court Drive ,

Suite 600

Cerritos, California, 90703

Phone: 888-888-6542

Los Angeles Office

Gas Company Tower

555 West Fifth Street,

31st Floor

Los Angeles, California, 90013

Phone: (213)-400-4132

Long Beach Office

Landmark Square

111 West Ocean Blvd.,

Suite 400

Long beach, California, 90802

Irvine Office

Oracle Tower

17901 Von Karman Avenue,

Suite 600

Irvine, California, 92614

Phone: (949)-203-3971

Fax: (949)-203-3972

Ontario Office

Lakeshore Center

3281 E. Guasti Road,

7th Floor

City of Ontario, California, 91761

Phone:(909)-996-5644

Riverside Office

Turner Riverwalk

11801 Pierce Street,

Suite 200

Riverside, California, 92505

Phone: (909)-996-5644

San Diego

Emerald Plaza

402 West Broadway,

Suite #400

San Diego, California, 92101

Phone: (619)-885-2070

Aliso Viejo

Ladera Corporate Terrace

999 Corporate Drive,

Suite 100

Ladera Ranch, California, 92694

Phone: (714) 721-3822

Call Today:

Call Today: