Bank Levies

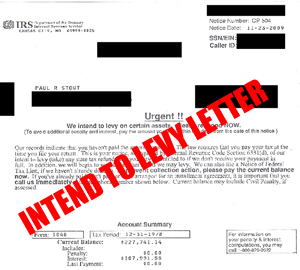

IRS Bank Levies – State Bank Levies

An IRS bank levy on your bank account can be disastrous. IRS Bank levies can cause critical checks to bounce, expensive bank service charges, and loss of funds you need for ongoing living expenses.

How is a Tax Levy different from a Tax Lien?

A tax levy is an actual legal seizure of your property to satisfy a tax debt. A tax levy is different from a tax lien. A tax lien is a claim used as security for the tax debt. A taxpayer will have tax liens noted on their Credit Reports which will make getting any kind of future credit or mortgage virtually impossible until the lien is satisfied.

A tax levy is an actual legal seizure of your property to satisfy a tax debt. A tax levy is different from a tax lien. A tax lien is a claim used as security for the tax debt. A taxpayer will have tax liens noted on their Credit Reports which will make getting any kind of future credit or mortgage virtually impossible until the lien is satisfied.

The IRS gives the taxpayer plenty of notice

The IRS will not levy a bank account, wages or property until three requirements are met:

- The IRS assessed a tax and sent the taxpayer a Notice and Demand for Payment.

- The taxpayer refused or neglected to pay the tax.

- The IRS sent the taxpayer a Final Notice of Intent to Levy and Notice of Your Right to A Hearing 30-days before the levy.

Bank Tax Levies should be avoided at all costs

Both Wage Garnishment Levies and Bank Tax Levies are generally the result of poor communication between the taxpayer and the IRS or no communication (or response by the taxpayer to the escalation of collection efforts). The Tax Resolution Lawyers here at Vincent W. Davis and Associates understand why taxpayers fail to communicate with the IRS and other tax agencies. It is human nature. Faced with economic issues and the feelings of powerlessness to take care of any current or old tax problems, many taxpayers will collect the envelopes —unopened— in a growing stack until some future time when circumstances might improve. Unfortunately, putting ones head in the sand proves to be a foolish choice. A taxpayer may choose to ignore the IRS, but the IRS will not ignore the taxpayer. No matter the taxpayer’s current dire circumstances, a Tax Resolution Lawyer can stop or minimize IRS actions. If you are being threatened with a levy or a wage or bank levy action has begun, call us. We can help.

Facts Taxpayers should know about IRS Bank Levies

- IRS bank levies are only valid for the one day the levy is received by the bank.

- The bank is required to hold whatever amount is available in your account that day —up to the amount of the IRS levy— and then send those funds it to the IRS in 21-days.

- The typical IRS bank levy does not affect any future deposits made into your bank account. It is possible that the IRS will issue another Bank Levy if the first one came up empty or short of the tax owed.

What can the Taxpayer do if their Bank Account was Levied?

An IRS bank levy is not an open-ended action that sucks up every dollar you or your employer might deposit to your bank account. The typical IRS bank levy is a one time only, day the bank receives the request, deduction (up to the amount of tax owed) from your bank account. You can read more about the laws in the Internal Revenue Manual 5.11.4.3.

Federal tax law gives the taxpayer a 21-day window to petition the agency to resend the levy and have the funds held released back to the taxpayer’s account before the bank forwards the levied funds to the IRS. This 21-day waiting period, mandated by Internal Revenue Code 6332(c), provides an opportunity for your tax resolution lawyer to contact the IRS and negotiate a release of the levy so that the money being held in trust will be returned to your account.

Does my bank have to give me notice before freezing my account? No. Unfortunately, the law provides that when the bank receives a levy notice, it must freeze your account immediately, before notifying you. That is why most people discover that their account is frozen when they try to use their ATM cards and they suddenly do not work.

Get some help —Make that call!

The Tax Resolution Lawyers at Vincent W. Davis & Associates, provide a no-obligation, confidential consultation and have appointments available for evenings and weekends. Moreover, we accept all major credit cards and can make other payment arrangements so that we can help you get your tax problems straightened out without adding additional layers of financial burden on you and your family. We have seven convenient offices throughout Southern California, including Los Angeles County, Orange County, Riverside County and San Bernardino County. To schedule a confidential consultation with one of our Tax Resolution Lawyers, call 626-446-6442.

Where We Can Meet You? - Contact An Attorney Now

Arcadia Office

150 N. Santa Anita Ave,

Suite 200

Arcadia, CA 91006

Phone: (626) 446-6442

Fax: (626)-446-6454

Beverly Hills Office

9465 Wilshire Blvd.

Suite 300

Beverly Hills, CA 90212

Phone: (310)-880-5733

La Mirada Office

Cerritos Towne Center

17777 Center Court Drive ,

Suite 600

Cerritos, California, 90703

Phone: 888-888-6542

Los Angeles Office

Gas Company Tower

555 West Fifth Street,

31st Floor

Los Angeles, California, 90013

Phone: (213)-400-4132

Long Beach Office

Landmark Square

111 West Ocean Blvd.,

Suite 400

Long beach, California, 90802

Irvine Office

Oracle Tower

17901 Von Karman Avenue,

Suite 600

Irvine, California, 92614

Phone: (949)-203-3971

Fax: (949)-203-3972

Ontario Office

Lakeshore Center

3281 E. Guasti Road,

7th Floor

City of Ontario, California, 91761

Phone:(909)-996-5644

Riverside Office

Turner Riverwalk

11801 Pierce Street,

Suite 200

Riverside, California, 92505

Phone: (909)-996-5644

San Diego

Emerald Plaza

402 West Broadway,

Suite #400

San Diego, California, 92101

Phone: (619)-885-2070

Aliso Viejo

Ladera Corporate Terrace

999 Corporate Drive,

Suite 100

Ladera Ranch, California, 92694

Phone: (714) 721-3822

Call Today:

Call Today: