Tax Lien

IRS Tax Lien – State Tax Lien

An IRS tax lien or state tax lien is the first major step that the IRS and/or state will take against a taxpayer in order to collect back taxes from an individual. Besides becoming a major strike against your tax record and your credit report, a tax lien acts as an insurance policy to ensure the tax liability is not overlooked if other creditors should file suit and attempt to collect from you, a bankruptcy is filed, or the taxpayer attempts to sell their real estate, buy other real estate, or even apply for credit.

An IRS tax lien or state tax lien is the first major step that the IRS and/or state will take against a taxpayer in order to collect back taxes from an individual. Besides becoming a major strike against your tax record and your credit report, a tax lien acts as an insurance policy to ensure the tax liability is not overlooked if other creditors should file suit and attempt to collect from you, a bankruptcy is filed, or the taxpayer attempts to sell their real estate, buy other real estate, or even apply for credit.

A Tax Lien tells the world that the IRS or State has first claim of your property and assets

By filing a tax lien, the IRS or state tax agency gives public notice to your creditors (current or future) that the government has a first priority claim on your residential or commercial property, or any bank accounts you may have.

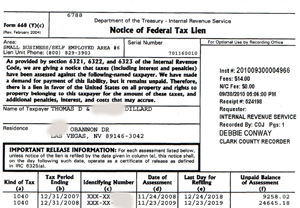

During the collection of past due taxes, the IRS may file a Notice of Federal Tax Lien to secure the government’s interest. Sometimes the IRS will even do this even if a taxpayer has agreed to a payment solution with the agency. A lien is required by law to establish the government’s priority as a creditor which determines the “pecking order” with other creditors in common situations, such as bankruptcy proceedings or some future sale of real estate. Once a lien is filed, it will likely appear on a taxpayer’s credit report and will undoubtedly significantly harm a taxpayer’s credit rating. For that reason alone, it is important that a taxpayer work to resolve a tax liability as quickly as possible, before a tax lien filing becomes necessary. The same scenario applies to state taxing authorities.

Our Tax Resolution Lawyers may be able to persuade the IRS or State to release, withdraw, or subordinate its lien in situations such as:

- Complete payment of taxes owed

- Acceptance of an IRS Installment Agreement

- Acceptance of a taxpayer’s Offer In Compromise (OIC)

- Acceptance of a bond as guarantee of payment

- Tax agency that violated procedural requirements for filing of an IRS tax lien

- Tax agency violated standards of due process

- Notification of bankruptcy proceedings

- Automatic release of tax lien after 10-years (when certain requirements are met)

Expert help getting your lien released, discharged or subordinated

While it is always best to head off the filing of a state or IRS tax lien before it is filed or immediately thereafter, in reality, tax liens are most often addressed only when they threaten to prevent the refinancing or selling of a home or business property. Our Tax Resolution Lawyers can work effectively to have your state or federal tax lien released, discharged or subordinated. The state and IRS are most willing to subordinate a lien when doing so won’t hurt its interests —and might even help the taxpayer— such as a situation where your net income will increase by getting a more favorable mortgage loan resulting in a smaller payment, resulting in more left-over income (to pay the IRS), and even create a more valuable real estate asset (this would be the case if a better loan is assumable) – thus making it more likely that you will be able to pay down your tax liability.

No matter how far the collection process has advanced – Call a Professional

The IRS is one of the most aggressive and powerful debt collector agency in the country —if not the world. If you owe back taxes, the IRS will do whatever it takes to collect them from you. This includes putting liens on your personal or business property, levying your property, emptying your bank accounts and even garnishing your wages. No matter where the collection process is, give our Tax Resolution Lawyers a call. You might be pleasantly surprised how easy it is to have the tide turn in your favor when a professional tax attorney gets involved.

Get some help —Make that call!

The Tax Resolution Lawyers at Vincent W. Davis & Associates, provide a no-obligation, confidential consultation and have appointments available for evenings and weekends. Moreover, we accept all major credit cards and can make other payment arrangements so that we can help you get your tax problems straightened out without adding additional layers of financial burden on you and your family. We have seven convenient offices throughout Southern California, including Los Angeles County, Orange County, Riverside County and San Bernardino County. To schedule a confidential consultation with one of our Tax Resolution Lawyers, call 626-446-6442.

Where We Can Meet You? - Contact An Attorney Now

Arcadia Office

150 N. Santa Anita Ave,

Suite 200

Arcadia, CA 91006

Phone: (626) 446-6442

Fax: (626)-446-6454

Beverly Hills Office

9465 Wilshire Blvd.

Suite 300

Beverly Hills, CA 90212

Phone: (310)-880-5733

La Mirada Office

Cerritos Towne Center

17777 Center Court Drive ,

Suite 600

Cerritos, California, 90703

Phone: 888-888-6542

Los Angeles Office

Gas Company Tower

555 West Fifth Street,

31st Floor

Los Angeles, California, 90013

Phone: (213)-400-4132

Long Beach Office

Landmark Square

111 West Ocean Blvd.,

Suite 400

Long beach, California, 90802

Irvine Office

Oracle Tower

17901 Von Karman Avenue,

Suite 600

Irvine, California, 92614

Phone: (949)-203-3971

Fax: (949)-203-3972

Ontario Office

Lakeshore Center

3281 E. Guasti Road,

7th Floor

City of Ontario, California, 91761

Phone:(909)-996-5644

Riverside Office

Turner Riverwalk

11801 Pierce Street,

Suite 200

Riverside, California, 92505

Phone: (909)-996-5644

San Diego

Emerald Plaza

402 West Broadway,

Suite #400

San Diego, California, 92101

Phone: (619)-885-2070

Aliso Viejo

Ladera Corporate Terrace

999 Corporate Drive,

Suite 100

Ladera Ranch, California, 92694

Phone: (714) 721-3822

Call Today:

Call Today: